The Customer Lifetime Value to Customer Acquisition (LTV:CAC) is the ratio of lifetime revenue of a customer, and the cost of acquiring that customer. This metric denotes the profitability. At no point, should the ratio be less than or equal to 1, which denotes that your business is running at a loss or not making profit. This metrics is very crucial for a subscription model business where the recurring revenue (MRR) forms the backbone of the business. Hence customer retention is of utmost importance for subscription businesses and hence LTV.

How to calculate Lifetime Value to Customer Acquisition ratio (LTV:CAC)

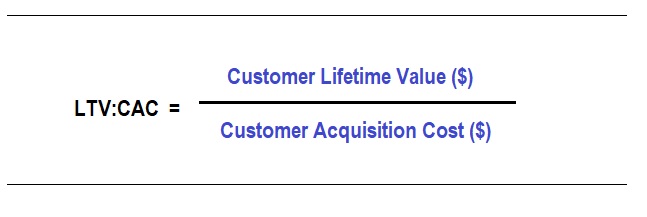

LTV:CAC

This ratio is calculated by dividing customer lifetime value by customer acquisition cost

LTV

Customer Lifetime value shows the value a customer spends at your organization during their entire lifetime before they churn. The longer a customer stays the longer is their lifetime value. LTV is calculated as below:

Read more on the LTV calculation here.

The longer a customer sticks around, the more valuable they are. Thus, a higher customer lifetime value shows a higher customer loyalty and thus lesser customer churn. However, a higher LTV does not necessarily indicate that you are making a profit. It can be called profitable only when your customer lifetime value is compared with you customer acquisition cost.

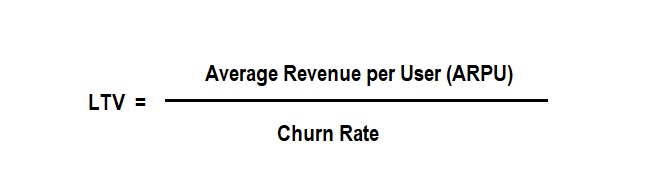

CAC

Customer Acquisition cost is the total cost incurred to make a customer initially purchase the service/products being sold. Hence, CAC is the sum of all sales & marketing expenses divided by the total number of new users acquired. CAC can be calculated as below:

A lower CAC shows that your sales and marketing is effective. The lower the CAC the better. However, a higher CAC could be a caution signal. Due to the increased competition, brands are scaling up on their acquisition efforts to keep up with the competition. However, if the CAC is drastically increased and not budgeted related to LTV, then the organizations profitability can suffer.

Ideal LTV:CAC ratio

An ideal LTV:CAC ratio is 3:1. This is a common benchmark for a good LTV to CAC ratio. This means that your customer is spending in your organization 3 times what you spent on acquiring that customer. A consistently lower than 3 ratio denotes that your business is moving towards a loss-making trend. A too high ratio, denotes that you are making good profit, which you are not pumping back to grow the business more. Higher ratio, indicates scope for more growth opportunity. You will need to scale up your marketing and advertising spend.

| LTV:CAC Ratio | Denotes | Indicators |

| <1 | LTV less than CAC | Loss making. |

| 1 | LTV equal to CAC | Not making profit |

| 3 | LTV is 3 times greater than CAC | Ideal growth |

| >5 | CAC is 5 or more times greater than LTV | More growth opportunity |

Customer Lifetime Value & Customer Acquisition Relation

The LTV:CAC metrics has lots of information within it. It throws light on the value of your customers, your spend on marketing and sales, as well as your customer retention. Knowing all of this, will help you refine your processes and create and budget accurate marketing strategies. You should always aim for a higher LTV to CAC ratio. You will be at a more profitable position, when you spend less to acquire a customer and the customer stays longer with you and spends more at your organization.

LTV:CAC is one of the most vital metrics for any subscription business. It throws light on the company’s health and potential growth. So, it is very important to track and regularly monitor this metrics. A sudden increase, decrease or even narrowing of the ratio should be monitored carefully. A trend around 3 represents a normalised and sustainable LTV:CAC ratio.