Customer lifetime value (CLV) or Lifetime value (LTV), represents the total amount of money a customer is expected to spend in your business, during their lifetime before they churn. This is one of the most important metrics for a subscription-based business, as they rely on recurring customers/revenue. This metrics helps to identify the ideal limit to your Customer acquisition cost (CAC), and how to plan the budget for marketing, discounts and other customer retention strategies.

How to calculate Customer Lifetime value?

Suppose your monthly subscription cost is $100 and a customer stay for 12months. Then that CLV/LTV is 100X12 = $1200

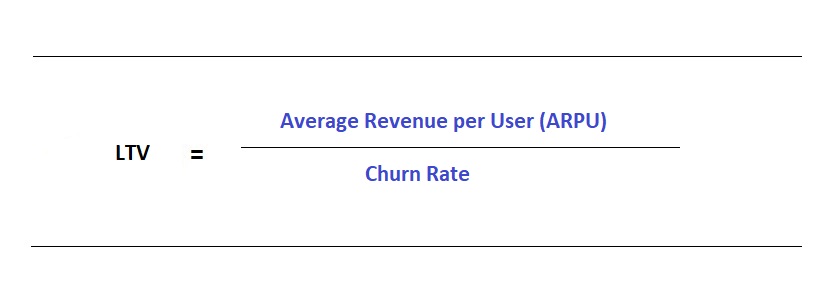

However, this is only for a single customer, and for the entire business, LTV can be calculated as below:

Average Revenue per User (ARPU) = Total MRR / Total # of users

Churn Rate is the customers cancellation rate in a given period of time

Suppose your total MRR is $100 and number of users is 4 and there was a 1 customer churn.

ARPU = $100 / 3 = 33.33

Churn rate = 1/4 = 25%

LTV = 33.33 / 25% = $ 133.32

This shows that you need to have a Customer acquisition cost lesser than $133.32 . If you spend $1000 and acquired 7 customers, it would not be a good return over your investment, as the lifetime value you are getting is lesser than the cost spent for each customer acquisition.