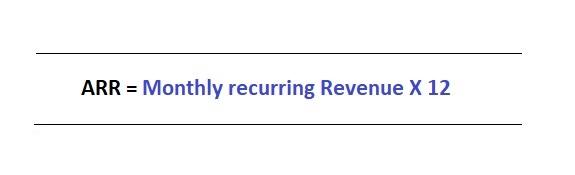

Annual recurring revenue or Annual run rate is the sum of all monthly recurring revenue expressed as an annual value. Based on the current monthly recurring revenue, the future forecast ARR can be calculated.

ARR calculation is based on the fact that the recurring revenue remains unchanged for the whole year. If the organization has a target ARR; based on the current MRR, you can know how much close you will be to the targeted ARR.

How to calculate Annual run rate or Annual recurring revenue?

For a subscription-based business, if a customer subscribes for a monthly recurring plan for $500. The ARR would be $500 x 12 months. This assumes that the customer does not churn. nor does he downgrade or upgrade during this period.

If you have 10 subscribers to the above monthly recurring plan. The total MRR will be 10 X $500 and the ARR will be $5000 X 12. Calculate ARR as shown below.

ARR calculation is with the monthly recurring revenue. Exempt all one-time payments and metered values for ARR calculation.

Tracking ARR gives an overview of the financial health of your organization. It also helps in forecasting the potential revenue from recurring plans. If you see a dip in your ARR, that shows the MRR is at a decreasing trend and it calls for a high alert.