An online business needs a payment gateway if they wish to accept credit card payments on their website. Many business owners are unsure about what payment gateways are; so here’s everything you need to know about them and how to put one up for your company.

The Payment Gateways act as a link between your customer and the business; ensuring safe and quick transactions. It is a software that gathers and sends payment data from a customer to an acquirer. Then it returns the payment acceptance or declines to the customer for any transaction. It secures the cardholder’s information, guarantees that money is accessible, and allows businesses to be paid. It maintains the customer’s sensitive card data between the acquirer and the business as a mediator during the payment process.

The Payment Gateway keeps the payments ecosystem running smoothly by allowing customers and companies to make online payments. You don’t need to be an expert in this to run an online business; but it’s good to know how an online payment system works.

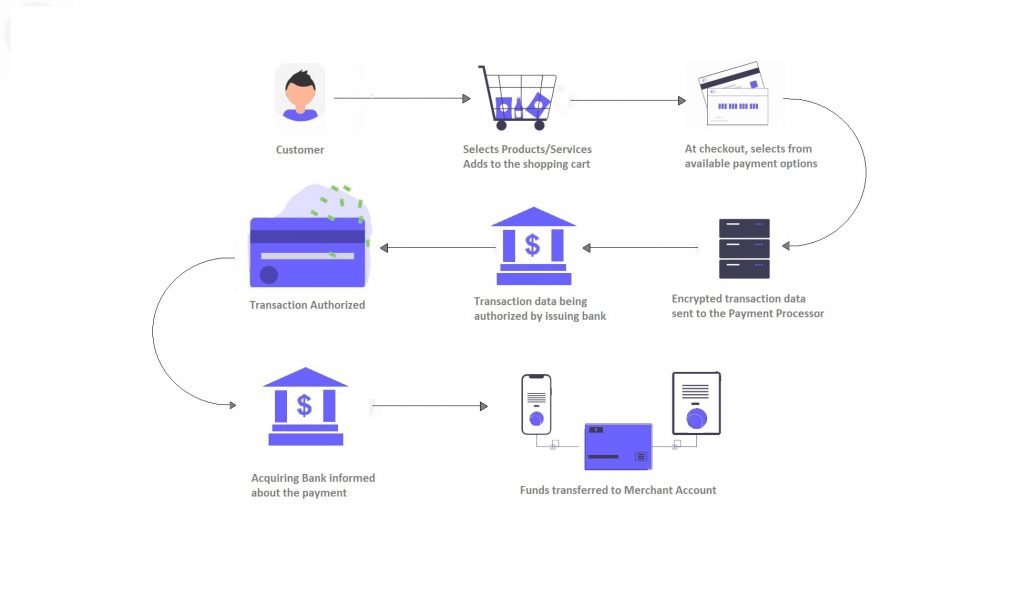

How does the Payment Gateway work?

The payment gateway follows a certain method to complete the transaction. When a consumer placed an item online and then pays for it, he or she must provide credit/debit card information. Following that, the merchant sends transaction data to their payment gateway; which then sends the information to the payment processor utilised by the merchant’s acquiring bank. The transaction data is sent to the card association(Visa/MasterCard/American Express) by the payment processor. Following that, the credit card issuing bank gets the authorisation request. Validates the available credit or debit, and then responds to the processor. The processor then sends the authorization answer to the payment gateway; which accepts it and passes it forward to the interface that will be used to process the payment.

Need for payment gateway

Any business that wants to accept internet and credit card payments needs a payment gateway. The technology sends financial data to the appropriate parties in order to approve payments and transfer funds from a client to a merchant. It guarantees that the information you provide is secure. SSL (Standard Security Layer) is the industry-standard security protocol for online transactions. It secures critical card information and verifies the customer’s identity. One of the most significant security measures in the payment gateway is data encryption; which makes the data jumbled and illegible to anybody but you. Tokenization in which a string of encrypted characters replaces sensitive card data; is another unique method for a safe transaction via a payment gateway.

A few popular payment gateways are Stripe, Paypal, Razorpay, 2checkout, CCAvenue etc. For detailed information, please check – Popular Payment Gateway.

Conclusion

Overall, payment gateways streamline your business’s online payment procedure, allowing you to collect payments faster, more easily, and securely. This is what you need if you wish to accept online payments; or if you want to improve the approach your business is presently utilising.